A Red Cross charitable gift annuity offers you the ability to make a significant gift while enjoying income for life that is largely tax exempt.

Benefits of a Charitable Gift Annuity

- Safe secure stream of income that is largely tax-exempt.

- Better return than is currently possible through a GIC or Bond.

- A charitable tax receipt for the charitable portion that can be applied for tax relief for up to five years.

- No reduction of your Old Age Security (OAS).

- Ability to meet your philanthropic goals during your lifetime

- Are not part of an estate and therefore not subject to probate fees

For your personalized quote, please contact your local Red Cross planned giving representative. There is no obligation in requesting a quote.

Note: This is a gift type suited to people who are 65 years or better.

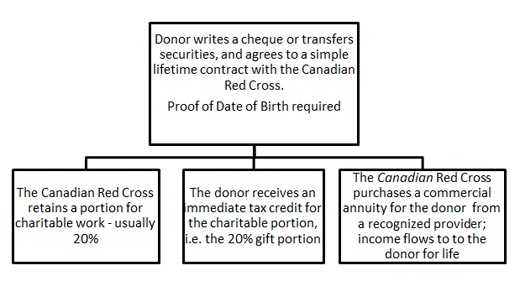

How a Charitable Gift Annuity Works

The Canadian Red Cross encourages you to speak with your financial planner to discuss which type of Gift Planning best suits your individual needs and goals.